- -Lower Operating Costs

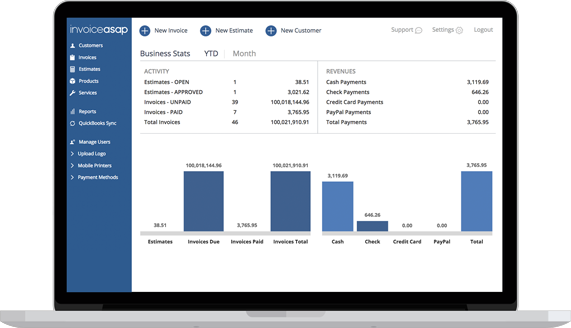

- –Monitor Outstanding Invoices

- -Reduce Days in A/R

- –Become PCI/DSS Compliant

- -Operate your Practice with more Efficiency

- –Offer Flexible Payment Options for Patients

Mobile/Handheld Payments

Countertop Payments

Online and Patient Portal Payments

Patient Financing Solutions

We approve 85% of applications, and can finance up to $25,000. The best part is you receive payment from the patient immediately! No more waiting for checks in the mail!

Electronic Invoicing

Capital Advances, Business Loans, and Lines of Credit

- Expansion

- Renovation

- Inventory

- Equipment

- Payroll

- Marketing

Seven tips for smoothing out your small business’ cash flow

With some simple tricks in cash management, the ups and downs of income vs. expense tides can be stabilized.

Staying Alive:

Sustaining a Small Business

Much has changed since the ’70s, but some things remain true for owners: Keeping your small business going requires adaptability and foresight.

Why alternative financing options might be best for your small business

About half to two-third of these businesses seek financing from a number of places, from owner investments to non-bank sources.